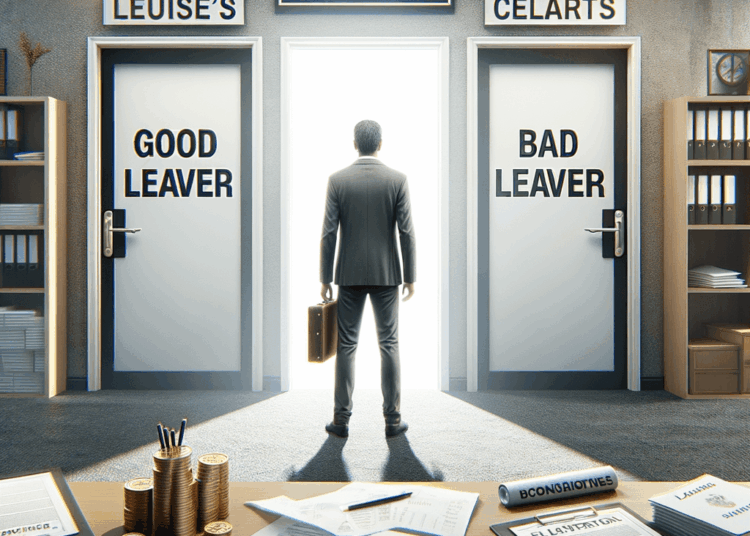

Conflict case founder exit – good leaver/bad leaver clauses

The premature exit of a co-founder is one of the trickiest conflicts in any start-up. Founder teams invest time, ideas and often their own capital together in building up the company. However, when a co-founder leaves the startup unexpectedly – whether for personal reasons, due to disputes or by resigning – burning questions arise: What happens to their shares in the company? Should a departing founder continue to participate in the future success of the company even though they are no longer involved? Leaver clauses offer a contractual solution to this and have become an integral part of modern startup contracts. The following explains the significance of such clauses, how good leavers and bad leavers are defined, how vesting provisions are interlinked with them and which legal limits and best practices need to be observed when drafting them.

Importance of leaver clauses in the start-up founding team

In start-ups, the founding team is often the decisive factor for success. Investors and co-founders rely on all founders remaining on board for a certain period of time. A sudden exit can cause the young company to falter: Know-how is lost, projects fall through and the remaining founders are faced with extra work or gaps. In addition, a founder who leaves early may continue to participate in the future value of the company as a shareholder despite his or her exit – possibly without making any further contribution to its success. This can lead to considerable resentment and even jeopardize future financing rounds (investors do not like to see “dead bodies” in the cap table, i.e. shareholders who are no longer active).

This is precisely where leaver clauses come in. They regulate what happens to a founder’s shares in the event that they leave the company (known as a leaver event). The aim is to create a fair balance of interests: The startup is to be protected from free riders or conflict-related standstill, while at the same time the departing founder receives a predefined settlement for his shares – depending on whether he is considered a good leaver or bad leaver. In short, leaver clauses serve to stabilize the founding team and protect the company from the consequences of an unexpected founder loss.

In practice, such clauses are an integral part of shareholder agreements and investment contracts in the start-up sector. They are usually implemented when the company is founded or at the latest as part of the first venture capital financing. This means that all founders know what they are getting into right from the start: Those who leave early must expect consequences for their investment, depending on the reason for leaving. This transparency can prevent tensions in the team and creates clear conditions in the event of an emergency.

Good leaver vs. bad leaver: definitions and objective criteria

Not every departure is the same: Was the founder leaving voluntarily or involuntarily? Was there any misconduct? This determines whether a departing co-founder is contractually classified as a good leaver or a bad leaver. This distinction is crucial, as it has different consequences for the severance payment and the retention of shares.

A good leaver is a founder who leaves the company for reasons that are not considered culpable or disloyal. Typical good leaver reasons are, for example

- Serious illness or death: If a founder can no longer perform his role for health reasons or if he dies, this should not be a “punitive departure”. As a rule, his heirs or he himself should not be fobbed off with a symbolic severance payment.

- Personal circumstances: This may include moving abroad for family reasons or a drastic change in your life situation that makes further employment unreasonable.

- Leaving by mutual agreement: Sometimes the team jointly determines that a founder no longer fits into the company and parts ways without rancor. If everyone agrees that the exit is in the best interests of the startup, this founder is often treated as a good leaver.

- Dismissal through no fault of their own: If a founder who is also an employee of the company (e.g. as managing director) is dismissed or removed by the advisory board or the co-shareholders without good cause, there is no misconduct on his part. Such an involuntary departure can also be considered a good leaver, depending on the definition of the contract.

A bad leaver, on the other hand, is a founder who leaves the startup under circumstances for which he himself is responsible or which are classified as disloyal. Here are some objective criteria that usually justify a bad leaver case:

- Resignation or voluntary departure: If a founder leaves the company of his own free will (e.g. to pursue another project or due to “personal differences”), he is usually classified as a bad leaver. After all, it was his decision to leave the team.

- Termination for good cause: If the founder commits a serious breach of duty – such as fraud, embezzlement, gross violations of the articles of association or the duty of confidentiality – and is therefore terminated as managing director without notice or excluded from the company, he is clearly a bad leaver. In such a case, the company should be protected as much as possible.

- Violation of non-competition clauses: If the co-founder secretly founds a competing company or does something that significantly harms the startup, this justifies classification as a bad leaver.

- Other culpable behavior: This also includes, for example, the deliberate sabotaging of business relationships, theft of company assets or other significant breaches of contract by the founder.

It is important that good leavers and bad leavers are clearly and objectively defined in the contracts. Unclear clauses lead to disputes: a founder who leaves will like to see himself as a good leaver, while those who stay may want to classify him as a bad leaver. It is therefore advisable to define precisely in the agreement which events or behaviors fall under which term. Lists of typical cases are often formulated (as above), supplemented by a general catch-all term for “good cause”. This makes it easier to make a classification in an emergency without relying on subjective feelings.

There can also be intermediate categories, such as intermediate leaver, if you want to provide for gradations (rarely in practice) – but as a rule, the good vs. bad dichotomy is sufficient. It is crucial that the criteria are objectively verifiable (e.g. court-proof reasons such as termination without notice for good cause, medical certificates in the event of illness, etc.) in order to achieve legal effectiveness and minimize difficulties of proof.

Vesting regulations and leaver clauses: combination to protect the shares

Leaver clauses almost always occur in conjunction with vesting provisions. Vesting originally comes from the US start-up environment and refers to a mechanism in which founders have to “earn” their shares over time. This means that although a founder nominally receives or holds all his shares at the beginning, they are treated as if they were only finally acquired bit by bit. If the founder leaves the company before the end of the vesting period, his shares are forfeited or reduced in accordance with the vesting logic.

A typical example: the founders agree a vesting period of 48 months (four years) with a cliff of 12 months. This means that only when a founder has been involved for at least one year has he “vested” anything at all. If he leaves before this (within the first 12 months), he loses 100% of his shares as if he had never been a shareholder – this is the cliff rule. Monthly vesting then begins from month 13: e.g. 1/48 of the original shares vest each additional month. After four years, all shares would befully vested. If the founder leaves after, say, 18 months, he would therefore have permanently acquired 18/48 = 37.5% of his shares; the remaining approx. 62.5% expire or must be returned.

Vesting and leaver clauses are therefore intertwined: unvested shares (shares that have not yet been “earned”) should generally revert to the company or the co-founders when a founder leaves, regardless of whether they are good or bad leavers. There is usually little dispute here, as it is considered fair that no one is allowed to keep shares that they have not yet earned due to a lack of seniority. Accordingly, the contract stipulates that in the event of a leaver, unvested shares must be returned without compensation or at their pure nominal value (effectively a forfeiture of these shares).

Things get more exciting with the shares that have already been vested. This is where the good/bad leaver distinction comes into play: depending on how the founder left the company, his or her vested shares are dealt with differently. A good leaver is typically compensated fairly for the shares he has already “earned” (often at market value or at least at an appropriate book value). A bad leaver, on the other hand, must also sell his already vested shares at a heavily discounted price or even at nominal value – as a sanctioning consequence for abandoning or damaging the startup.

This combination – vesting schedule plus good/bad leaver rule – creates a balanced system: on the one hand, it prevents early leavers from benefiting unduly (no “free lunch” for someone who leaves the team early). On the other hand, there is an incentive to remain involved at least until the vesting period expires in order not to lose the shares. This structure is often a prerequisite for investors: they only invest if it is ensured that the founding team will stay together or that the shares can be redistributed in the event of a departure (e.g. to replacement personnel or for employee shares). From the perspective of the founding team itself, vesting protects against the scenario of a co-founder leaving after a short time with a large shareholding and blocking the cap table.

Contractual implementation in participation agreements and articles of association

The theory sounds good – but how are leaver clauses and vesting provisions anchored in practice? This is where investment or shareholders agreements and articles of association come into play. Usually, the leaver/vesting agreement is already regulated in detail in the investment or founder agreement, often with examples. However, it is imperative that certain components are drawn up in a legally effective manner, otherwise there will be problems with enforcement.

A central element is the irrevocable declaration of offer submitted in advance by each founder for their shares. What does this mean? At the time the contract is signed (e.g. when the company is founded or when an investment is made), each founder signs a written offer to transfer their shares to the co-shareholders or the company under certain conditions (i.e. in the event of a leaver). This offer is irrevocable and valid for the duration of the vesting period. If the leaver case now occurs (the founder resigns, is terminated, etc.), the other shareholders or the company can accept this offer – the share is then transferred as agreed. This procedure avoids the problem that a departing shareholder may later no longer be willing to cooperate. Otherwise, they would have to be persuaded to transfer their shares at a later date, which would be almost impossible to enforce without a prior agreement.

A typical formulation of such a clause could read as follows (simplified):

“If a founder leaves the company as a managing director or employee before [date/vesting end] or intentionally breaches his duties (bad leaver), he is obliged to offer the shares held by him as follows: at nominal value for all non-vested shares and at [nominal amount or a reduced price defined in the contract] for the shares already vested. If a founder leaves the company for reasons beyond his control (good leaver), he shall offer his non-vested shares to the remaining shareholders for purchase at nominal value and the vested shares at market value (determined according to objective standards or by an independent expert).”

Such or similar provisions are usually set out in detail in the shareholders’ agreements. At the same time, it is advisable – and common – to provide for corresponding authorizations or redemption provisions in the articles of association of the GmbH. For example, the articles of association can provide for the possibility of redeeming shares when a shareholder leaves the company for important reasons or in accordance with a vesting clause defined in the articles of association (Section 34 GmbHG allows for this, provided the conditions are clearly regulated).

Why use the articles of association? In the case of GmbHs, assignments of shares are subject to strict formal requirements (Section 15 (3) GmbHG requires notarization). If the vesting/leaver agreement is clearly anchored in the articles of association or has been notarized, it is ensured that formal objections do not lead to invalidity. In practice, vesting is therefore often notarized at the same time as the formation or capital increase – either by including a corresponding clause in the articles of association or by the founders offering the aforementioned offers in a notarial deed. This ensures enforceability: In the event of a dispute, for example, the registry court will only register a share transfer or redemption if the formal requirements are met.

In addition, the contract often specifies valuation mechanisms (more on this in the next section) and defines procedures: For example, how the remaining shares will be distributed (can the remaining founders take them on a pro rata basis? Or does the company withdraw them in return for compensation and hold them as its own shares in order to reissue them later?) Such details should be clarified in advance in order to be able to act swiftly when the founders actually leave the company. There are often deadlines: for example, the person leaving must offer their shares within 30 days of leaving and the others have a further 30 days to accept this offer. It can also be determined who is allowed to access the shares first (e.g. the company itself or the co-founders).

Important: Leaver clauses should apply equally to all founders. It would be fatal in terms of group dynamics if different rules applied or if individual founders were protected from the outset. Investors insist that the entire founder team enters into such commitments anyway. However, there can be differences between founders and pure capital investors: The latter are generally not subject to vesting – after all, they have primarily contributed money and have not agreed to perform any work. For this reason, formulations such as “These vesting/leaver provisions apply exclusively to the founding shareholders; investor shares are exempt from vesting” are frequently found. This also does not violate the principle of equal treatment in company law, as founders and investors are in a significantly different position.

Valuation standards: amount of compensation for good leavers and bad leavers

At the heart of every leaver arrangement is the question: How much does the departing founder get for his shares? This is where the difference between good and bad leavers becomes most apparent. The contracts define valuation mechanisms that should be fair on the one hand, but also reflect the respective reason for leaving on the other.

Essentially, two extreme assessment criteria are used, depending on the leaver status:

- Nominal value or purchase price (minimum settlement): It is common practice for bad leavers to receive only a very low price for their shares. It is often agreed that he will sell at nominal value – i.e. practically for the original capital investment (which is often negligible in the case of founders, e.g. € 25,000 share capital distributed among all founders). Alternatively, the contract states that the bad leaver receives the lower of the acquisition costs and the current market value. This is intended to prevent him from participating in any increase in value that occurs after his departure. Even if the value of the company has risen dramatically in the meantime, the bad leaver is then left empty-handed, apart from the symbolic residual amount. If, contrary to expectations, the company value is lower than what the founder originally invested (very rare in the early stages), this formula could even mean that the current market value is paid – but as a rule, the nominal amount is the upper limit. This harsh financial penalty underlines the fact that anyone who turns their back on the company of their own volition or misconduct loses the right to participate in its future success.

- Market value or appropriate value (full settlement): A good leaver, on the other hand, can be confident that he will receive an appropriate settlement for the shares he has already earned. It is often agreed to determine the current market value of the shares – for example, on the basis of a company valuation at the last financing round, through an expert clause or according to a fixed contractual formula (e.g. multiple of EBITDA, if applicable for start-ups). Alternatively, there is a provision that a good leaver may even keep their vested shares. In this case, he does not have to sell them at all, but remains a shareholder with his stake and can profit accordingly later on when he exits. However, this option is rarely chosen, as it effectively means that an inactive shareholder would continue to be dragged along – the parties often prefer to opt for a clean separation in return for compensation. However, a good leaver can at least claim the full economic equivalent value of their shares. The term “market value” is usually specified in the contract, e.g. “market value according to a company valuation using the capitalized earnings method” or “value of the company based on the price of the last investment round, extrapolated to 100% of the shares”. This makes it clear how the valuation is to be carried out.

- Intermediate forms: There are also mixed models between these poles. For example, it could be stipulated that a founder who leaves voluntarily (actually a bad leaver) but has already worked for a certain period of time is not left completely empty-handed: for example, payment of the book value of their share or a discount on the market value (e.g. 50% of the actual value). Although such clauses increase complexity, they can be helpful in avoiding extreme hardship and in structuring the clause in a legally appropriate manner. Some contracts also explicitly define a settlement amount for good leavers (e.g. “market value, but at least nominal value”) and for bad leavers (“nominal value or original purchase price, but at most market value, if this is lower”).

In any case, valuation rules should be transparent and clearly defined in order to prevent later disputes. In particular, mechanisms should be provided for determining the market value in the event of disagreement (e.g. the involvement of a neutral auditor as an arbitrator). With standardized approaches (nominal value, last investor price), there is less room for interpretation – but these can be perceived as unfair in the specific situation.

The bad leaver provision with nominal value replacement in particular is legally always somewhat in conflict with the principle that a departing shareholder should actually receive an appropriate severance payment. As we will see shortly, case law has made it clear that an unreasonably low severance payment can be problematic, but does not necessarily lead to the invalidity of the clause – rather, in case of doubt, a court can increase the amount of the severance payment to a reasonable amount instead of overturning the entire leaver clause.

Current case law: Admissibility and limits of leaver clauses (as of 2025)

Are good leaver/bad leaver clauses even effective in Germany? This question has been a hot topic in the startup legal community in recent years. The background to this is the so-called prohibition of dismissal in company law. In simple terms, this means Forcing a shareholder out of the company (withdrawing or transferring their shares) without an objective reason is contrary to public decency and is void under Section 138 of the German Civil Code (BGB). Every shareholder has a right of membership that may not be arbitrarily withdrawn. A complete “removal” without good cause was long regarded as inadmissible.

However, there are exceptions if there are objective justifications. Case law first recognized exceptions in connection with so-called manager participation models. Here, managing directors or senior employees received a small minority stake in the company – usually at a symbolic price – in order to share in its success(management incentive). In 2005, the Federal Court of Justice (BGH) ruled in a leading case that a clause may be permissible according to which a manager must return his shares acquired at nominal value when his employment ends (BGH, judgment of 09.09.2005). Why? The BGH reasoned that the manager:

- only held a small stake, which did not give him any significant power in the shareholders’ meeting,

- had not taken any significant capital risk of his own (he had hardly paid anything for the shares),

- and the shareholding was merely part of his performance-related remuneration (a kind of bonus, as the profits were distributed on a mandatory basis – he was to benefit extra as long as he was there).

Under these circumstances, the BGH saw an objective reason for the free retransfer: The shareholding was closely linked to the person and performance of the manager. If his active role ends, his participation should also be allowed to end – as a contractually agreed automatism, so to speak.

Transfer to founder vesting: For a long time, it was assumed in startup practice that this principle could be transferred one-to-one to founders, as shares are also linked to continued collaboration here. But be careful: founders are usually not just “employee-like” bonus recipients, but entrepreneurs and often substantial shareholders. This realization led to a sensation in 2020:

The Munich Higher Regional Court (judgment of 13.05.2020) had to decide on a vesting clause that forced a shareholder to leave the company. The manager in question held around 25% of the shares, had also invested considerable funds of his own and was one of 17 shareholders – i.e. not a tiny “bonus share”, but a relevant company share. The Munich Higher Regional Court did not consider this constellation to be comparable to the BGH manager case. Rather, according to the court, 25% is an entrepreneurial shareholding, the free withdrawal of which is unacceptable without good cause. The leaver clauses in that contract were classified as invalid by the Munich Higher Regional Court as there was no discernible objective reason for the forced transfer. Unlike in the previous cases, the shareholder concerned bore a real financial risk and had substantial rights – according to the court, “dismissing” him would be immoral.

This decision caused considerable uncertainty in the scene. It made it clear that the larger and more substantial the shareholding of a founder, the more critically courts look at whether a vesting clause may be inadmissible. If the founder is not merely an employee with a mini-share, but a substantial shareholder and investor in their own startup, an automatic withdrawal of shares without individual misconduct can be deemed inadmissible. (Note: The Munich Higher Regional Court ruling was not yet legally binding at the time; an appeal has been lodged with the Federal Court of Justice. However, a decision by the highest court specifically on founder vesting was pending for a long time, as the BGH had not yet issued a final ruling on this until 2025).

Turnaround by the Berlin Court of Appeal in 2024: A decision by the Berlin Court of Appeal (as a higher regional court) in 2024 brought a breath of fresh air. In a reference decision dated August 12, 2024 (case no. 2 U 94/21) – the first higher court ruling explicitly on a startup vesting clause – the Court of Appeal confirmed the effectiveness of a termination clause in founder vesting. The case: Three founders had agreed to vesting over three years following an investor round; however, one of them left the company after just a few months (his employment contract was terminated within the first year). According to the vesting agreement, he was to lose all his shares. The founder in question challenged this – but the Court of Appeal sided with the remaining founders and investors.

The court argued that vesting in the VC context was objectively justified. When external venture capitalists invest, they do so in reliance on the continued commitment of the founders. In the critical growth phase directly after the investment, it is legitimate to link the founders’ shareholder status to their continued involvement. Anyone who leaves during this phase – for whatever reason – should no longer be allowed to participate in future success. The Court of Appeal thus explicitly recognized a startup-specific objective reason for the first time: namely the protection of the investment and the other founders in the early phase of the company.

Particularly important: The Court of Appeal clarified that a vesting clause is not invalid simply because the compensation for the departing founder appears unreasonably low. In the specific case, the clause meant total loss within the first year – undoubtedly harsh. However, the court said that even if the agreed severance payment was not appropriate, this would not automatically render the clause invalid. Instead, in such a case, the agreed amount would be replaced by an appropriate severance payment (i.e. a court would determine a fair value in case of doubt) without overturning the leaver clause as such. This line protects the agreement itself and only corrects the amount paid out. In practice, this means that the termination clause remains effective – the founder must leave – but he could possibly receive more money if the clause puts him in an immoral position. In the Kammergericht case, however, the complete devaluation in the first year was not considered unreasonable: According to the court, it is reasonable that a founder must actively work for at least one year in order to “earn” his continuance as a shareholder. If he leaves the company before then, the total loss of his shares can be justified, even if there is no misconduct (in this case it was an ordinary termination of the employment contract, i.e. not a dismissal without notice for good cause, but the vesting still applied in full).

This decision is considered groundbreaking because it puts founder vesting clauses on a legally secure footing for the first time. However, it also makes it clear that context is crucial. The court emphasized that the vesting agreement here was closely related to a financing round. The unequal treatment – founders have to vest, investors do not – was explicitly justified by the different roles: investors provide capital, founders have to earn their “shares” through work. This also negated any violation of the principle of equal treatment under company law.

In summary, the status of case law (2025) can be outlined as follows:

- Leaver/vesting clauses are permissible in principle, provided there is an objective reason to justify the temporary linking of shareholder status and collaboration. In a start-up with fresh investor money, this reason is given (securing the founders’ cooperation in the initial phase).

- Manager models with smaller shareholdings have been recognized for some time. Caution initially applied to substantial founder investments (OLG Munich 2020), but the more recent decision shows greater acceptance.

- An unreasonable disadvantage to the departing employee (such as a completely worthless severance payment despite a high share) is examined by the courts. If it is blatant, the entire clause is not necessarily overturned, but the amount of the severance payment is adjusted (Section 138 BGB is thus “mitigated” in such a way that there is appropriate compensation at the end).

- There is still no supreme court (BGH) decision specifically on founder vesting, but the signs are positive that such clauses – if drafted correctly – will be upheld. In any case, the Berlin Court of Appeal has set standards that are likely to guide future proceedings.

How far can sanctions go? (Bad leaver and total loss)

A common concern of founders is: “Can they really take away all my shares if I leave the startup?” – especially if there is no misconduct, but rather personal reasons, for example. As we have seen, the permissibility of drastic sanctions depends on the temporal and factual components.

In principle, the closer the exit is to the start of the company and the more central the founder’s commitment is to the value of his shares, the more likely it is that a total loss or a large discount can be legitimized. In the initial phase, the company value is strongly linked to the individuals – without the commitment of the founders, there would be no value creation. If someone leaves the ship prematurely, it can be argued that they will not participate fully in the later success. Therefore, clauses that provide for an almost complete withdrawal of shares in the first 12-24 months are more tenable from a legal point of view (of course only if they have been consciously agreed by all shareholders).

On the other hand, it would be disproportionate to impose bad leaver sanctions such as nominal value compensation on a founder who leaves the company after 5 years of development work, for example, even though vesting has long since been completed. In such cases, there is no objective justification – the founder has “earned” his shares in full. Accordingly, strong sanctions should be limited in time: It is usual that after the vesting period has expired (e.g. 4 years), there is no forced disposal of shares. This means that if a founder leaves after the vesting period, he can keep his shares or sell them at free market value; the leaver clause effectively “ends”. Some contracts regulate this explicitly, others implicitly by applying the vesting mechanism only to the first few years.

The vesting period can also be staggered: many only provide for total loss in the event of very early departure (as in the aforementioned cliff year). If the founder leaves later, the penalty is correspondingly lower because parts have already been vested. Example: If a founder leaves in the third year (bad leaver), 50-75% of his shares may already have vested – he may also have to sell these, but perhaps no longer at nominal value, but e.g. at the reduced market value. This cushions the imbalance.

Maximum penalties for bad leavers – such as complete expropriation without compensation – are only advisable and legally justifiable in extreme cases. Critical cases can be important reasons in particular, i.e. behavior that massively damages the startup. An argument can be made here: Someone who causes damage to the company does not deserve to still benefit from its value. In such cases, even a total loss of the shares would probably be effectively agreed because the sanctioning character is justified by the misconduct (keyword: forfeiture of the share).

However, you should be careful with blanket punishments. Contractual clauses that make no distinction between a bad leaver who “only” leaves voluntarily and one who has sabotaged the company could be viewed critically in the event of a dispute. It is advisable to regulate bad leaver cases in a staggered manner – for example, by making the severance payment even lower in the case of really serious misconduct (e.g. fraud) than in the case of a “normal” voluntary departure. This shows that proportionality is being maintained.

In conclusion: Yes, total loss of shares is conceivable as a sanction and is covered by court rulings, but always on condition that the time period and context make this plausible. An unlimited gagging (e.g. “no matter when someone leaves, they always lose everything”) would certainly be ineffective. The trick is to provide for harsh but time-limited consequences for the critical phase and then rely on milder solutions.

Practical tips for founders: drafting leaver clauses fairly and with legal certainty

For founders and start-up teams who want to implement leaver and vesting clauses, the above gives rise to a number of recommendations. The regulations should be carefully balanced – they must protect the company, but also be perceived as fair to each other so as not to sow mistrust from the outset. Here are some best practices:

- Determine early on: Ideally, vesting and leaver categories should be agreed when the company is founded or at the latest before investors join. Then everyone involved knows from the outset what they are getting into. Introducing such clauses retrospectively is difficult and can easily lead to conflicts. In addition, investors usually demand vesting for founders in term sheets anyway – it is better to have an internally agreed regulation ready.

- Use clear, objective terms: The wording of the contract must clearly define what is a good leaver and what is a bad leaver. It is best to use concrete events (e.g. “death”, “incapacity to work due to a medical certificate”, “termination of employment contract”, “dismissal for good cause in accordance with Section *** BGB/GmbHG”, etc.). Avoid vague terms such as “good cause” without further context, or even judgmental terms such as “disloyal conduct” – such formulations leave room for interpretation disputes. It is better to have an exhaustive list of typical cases, possibly supplemented by a general clause that is closely linked to objective standards.

- Provide for an appropriate severance payment (in case of doubt): To be on the safe side legally, you can include a certain minimum quota or a review mechanism in the bad leaver settlement. For example, you could stipulate: “If the calculated value of the settlement is less than X% of the market value of the share, it shall be increased to this amount to the extent necessary to avoid immorality (Section 138 BGB).” Such clauses show that the parties have consciously considered the aspect of reasonableness. Alternatively, it can at least be contractually stipulated that the severance payment should be “reasonable in the sense of case law” – if the nominal value deviates extremely from the real value, it could then be argued in case of doubt that the clause should be understood to mean that at least a minimum value must be paid. Note: Although the Court of Appeal has made it clear that a judge will make the adjustment if necessary, it never hurts to proactively include a fairness component.

- Use staggering over time: Design vesting so that the harshest consequences are limited to the initial phase. A cliff (e.g. 1 year) with total loss in the event of a super-rapid exit makes sense and has proven itself in practice. After that, the founder should gradually accumulate shares so that his or her departure no longer leads to a complete loss after a longer period of time. You should also consider whether a leaver clause should apply at all after the end of vesting (e.g. after 4 years). Many contracts stipulate that all founders can freely dispose of their shares after full vesting – which is understandable for reasons of motivation and fairness.

- Handle good leavers generously: A fair structure also means cushioning genuine cases of hardship. If a co-founder leaves for reasons for which he is not responsible, he should at least receive the value of the company substance he has created. Practical: In the case of good leavers, the market value or a benevolent valuation method should be applied so that no one feels they are being punished twice in the event of misfortune. A retention solution (the good leaver can keep their shares) can also be considered if this is acceptable for the other founders. A compromise can often be found here, e.g. the good leaver keeps some of his shares and sells some to the co-founders – this way he retains a small stake, but active control remains with the rest of the team.

- Observe form and documentation: Ensure that all relevant agreements are in writing and notarized, if necessary. In the case of a GmbH, vesting and leaver clauses should ideally be anchored in the articles of association or at least secured by notarized offers from the founders. Also make sure that all founders enter into these rules voluntarily and in an informed manner – in the event of a dispute, this can make it easier to enforce them, as no one can then claim that they did not realize the implications.

- Establish mechanisms for cases of conflict: Consider in advance who will decide whether a case is a good or bad leaver if there is disagreement. Sometimes you stipulate that the shareholders’ meeting (without the person concerned) decides on this. Or the contract specifies neutral arbitration bodies for such assessments. Nothing is worse than when the status is disputed – then the effectiveness of the entire clause is up in the air. A clear responsibility and procedural rule (including deadlines and burden of proof) helps to structure the process.

- Communication and fairness in the team: Legal finesse or not – ultimately, such clauses should serve to create trust, not mistrust. All founders should understand the concept and accept it as fair. It is advisable to talk openly about why this regulation is important (protection against free riders, team trust, investor requirements). If everyone has the feeling that they themselves are being treated fairly in case of doubt, this strengthens cohesion. In the best case scenario, leaver clauses never come into play – they are a safeguard for emergencies, not a tool to be used lightly.

Conclusion: Good leaver/bad leaver clauses are a powerful tool for retaining startup founders in the long term and ensuring clear conditions in the event of a conflict. Used correctly, they protect the company and the active shareholders without being unfair. Current legal developments show that such agreements are permissible in Germany as long as they are sensibly balanced and well justified. Founders should work with experienced lawyers to draw up individual provisions and adapt them to their circumstances. This reduces the risk of a premature founder exit throwing the entire start-up off track – and all parties involved know in advance where they stand.