E-invoices from 2025: Are you prepared as a business owner?

Digitization is advancing in all areas, including invoicing. From 2025, entrepreneurs and self-employed persons in Germany must be ready to receive electronic invoices, so-called e-invoices. This obligation to accept e-invoices was adopted as part of the law implementing Directive (EU) 2019/2235 amending the VAT Directive with regard to the harmonization and simplification of certain provisions of the VAT system. But what exactly does this mean and what are the consequences? What technical requirements must be met and how can entrepreneurs best prepare for the changeover? In this blog post, we look at the most important aspects and give you valuable tips so that you, as an entrepreneur, can receive and process e-invoices smoothly from 2025. Because one thing is certain: e-invoicing is the future of invoicing and offers numerous advantages such as time savings, cost reductions and automated processes. Those who address the issue now and take the necessary steps will benefit from digitalization in the long term.

What are e-invoices?

E-invoices are invoices that are issued, transmitted and received in a structured electronic format. They differ from the previously widely used PDF invoices in that they are machine-readable and can be processed automatically. This saves time and reduces errors in accounting, as the data can be transferred directly to the accounting systems without the need for manual input. In addition, e-invoices are easier to archive and quicker to find, which facilitates administration and control. E-invoices must meet certain requirements in order to be considered as such. This includes a standardized format such as XRechnung or ZUGFeRD as well as compliance with VAT regulations. XRechnung is a standard developed by the public administration in Germany, which is based on the European standard EN 16931 and enables the simple creation, transmission and processing of e-invoices. ZUGFeRD (Zentraler User Guide des Forums elektronische Rechnung Deutschland) is a cross-industry standard that was developed jointly by associations and companies and is also based on EN 16931. Both standards ensure smooth communication between invoice issuers and recipients and provide a uniform structure for invoice data. In addition, e-invoices must also contain the mandatory information under VAT law, such as the full name and address of the supplier, the tax number or VAT identification number of the supplier, the date of issue, a consecutive invoice number and the time of delivery or other service. Only if all these requirements are met can an electronic invoice be recognized as an e-invoice and the associated benefits, such as input tax deduction and simplified archiving, be claimed.

Obligation to be ready to receive from 2025

Many entrepreneurs and self-employed people mistakenly believe that they are not yet affected by the obligation to use e-invoices from 2025, as they do not have to issue e-invoices themselves. But this assumption is a fallacy. From January 1, 2025, all entrepreneurs and self-employed persons will be obliged to be ready to receive e-invoices. This means that they must be technically capable of receiving and processing e-invoices, regardless of whether they send e-invoices themselves or not.

Being ready to receive e-invoices can be a challenge for many companies, especially if they have no previous experience with electronic invoice formats. The aim is to create the necessary technical conditions for receiving, processing and archiving e-invoices. This includes, for example, the purchase of suitable software that enables the receipt and processing of e-invoices in standardized formats such as XRechnung or ZUGFeRD. It may also be necessary to connect to an electronic archiving system in order to store the received e-invoices in an audit-proof manner and for the legally prescribed period.

Anyone who fails to comply with the obligation to be ready to receive e-invoices from 2025 risks severe fines and disadvantages in business transactions.

This is because business partners who have already switched to e-invoices also expect their customers and suppliers to be able to receive and process electronic invoices. A lack of readiness to receive can therefore lead to delays in invoice processing and, in the worst case, even to the termination of the business relationship. There are no transitional periods for the readiness to receive e-invoices. Entrepreneurs and the self-employed should therefore ensure that they meet the technical requirements in good time. Early preparation is crucial to ensure a smooth transition to electronic invoice processing.

In addition to purchasing suitable software, commissioning an external service provider can also be an option to ensure that e-invoices are ready to be received. Specialized providers take on the task of receiving and processing incoming e-invoices and forwarding them to the company’s accounting system. Entrepreneurs and the self-employed should not underestimate the obligation to be ready to receive e-invoices from 2025. Addressing the issue at an early stage and creating the necessary conditions in good time are essential in order to remain competitive in the future and benefit from the advantages of electronic invoicing.

No more entitlement to PDF invoices

With the introduction of the obligation toreadiness to receive e-invoicesat the same time the entitlement to the receipt of invoices in the PDF format. Unand self-employedwho previously relied on PDF-invoices for their bookkeepingwere dependent onhave to to the fact that that in future these no longer necessarily availablewill be. StMeanwhile billers are likely toincreasingly switch to sending their invoicesfinally in a structuredstructured electronicelectronic format such as XRechnung or ZUGFeRDend.

This can especially for smallcompanies andand the self-employed challengers, as they may not the necessarynecessary technicaland human resourcesand human resourcesto make the switchto e-invoices without any problems.to cope with. The Changeover doesrequires not only the purchase or rental of suitablesuitable software for the processing of e-invoices, butoften also an adaptation of the internal processesand processes. Withworkers must be trainedult in order to with the new systand proceduresto be trustedand it can be necessary, additional personnel or external service providers order to the increased requirementsorders to invoice processing to do justice to.

In addition especially smallercompanies often closely with their businessbusiness partnersandd on their supportsupportare shown. When these partners also not yet not yet switched to e-invoiceshave switched or technical problemsproblems with the transfertransmission andd processing of e-invoicesoccur, this can delays andd disruptions in cooperationen. It is thereimportant that companies forearly with theirpartnersimmense and commonDeveloping solutions togetherto get a frictionless Aboutaccess to electronics invoicing to guarantee.Despite this Challenges shouldsmaller unand self-employedthe Conversion to E-invoices not as an insurmountable Hbut as a grasp the opportunity. Dhen the electroniciscal invoice processing also offers many advantagesadvantages, such as faster andand more efficientprocessing of invoices, a reduction of sources of error andd a simplificationsimplification of the archivation. There are also there are now a variety of software solutions andservice providers that specifically the needs of small and medium-sizedsmall and medium-sized enterprisesare tailoredand a costinexpensive andand uncomplicatedintroduction of e-invoicestion of e-bills.

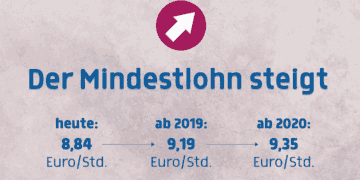

No more VAT from PDF invoices from 2026

Another importantaspect concernsconcerns thetax deduction from Invoices. From January 1 2026, companiesand self-employedself-employed persons sales tax only only from e-invoicesinvoices that meet the legal requirementsrequirementscalculate. PDF invoices that does not meet the crcriteria of an of an e-billthen no longer entitle no longer entitle Input tax deduction. The means that companies that until then not yet receive andreceive and processcan process themwill no longer be able to do so from 2026.t will no longer have the option of invoicesVAT shown on invoices as input tax as input tax.

But also as early as 2025 this probltheoretically become a come into play. Df the obligationobligation to be ready to receive for e-invoicesat the same time the entitlement to the receipt of an invoice in another other formatsuch as an PDF file. When a company from 2025 therefore no Receive e-invoicescan catch andd the invoicing party only still e-bills in the XInvoice or ZUGFeRD formatsends, the Invoice recipient factis no longer a possibilitythe input tax from of this calculation gto make it sustainable.This situation can lead to considerable financial disadvantageslead to a higher share, as the input tax a Significant foodfactor for uncompany. gEspecially for small and medium-sized companieswhich often have a highhave a high proportion of input taxthe loss of theloss of the input tax deduction canthreaten thehave consequences. It is therefore unessential that entrepreneurs andself-employed personsthe necessarythe necessary preconditionsto be able to receive receive and processand processbe able to process.

To prepare for the new rulesregulations, entrepreneurs shouldentrepreneurs shouldearly on with the technical andd organizational requirementsrequirements for the receipt andand processing of e-invoices fromto deal with. DThis includes the selection of suitable software or a serviceprovider that the processing of e-invoices in the XRechnung or ZUGFeRD formatpossible. Also the training of employees in dealing with the new processes andd technologies is an important stepstep to ensure a smooth transitiontransition to electronicelectronic invoice processing to electronic invoicing.

Conclusion

The switch to e-invoices is an important step towards digitization and offers many advantages such as time savings and error reduction. While there are no transitional periods for the receipt of e-invoices and companies must be equipped for this from 2025, the law provides for a gradual introduction for the issuing of invoices. Paper and PDF invoices can still be issued until the end of 2026, from 2027 this will only apply to companies with a maximum turnover of EUR 800,000 in the previous year and from 2028 all companies will have to issue e-invoices, unless exceptions apply. These transitional periods are intended to make the changeover easier for smaller companies in particular and give them more time to adapt their processes.

It is important to emphasize that the obligation to use e-invoices will apply to all companies from 2025, regardless of their size or sector. Regardless of whether you are a small business, craftsman, landlord or freelancer – every entrepreneur should explicitly prepare for the changeover. Because from 2025, there will no longer be any entitlement to any other form of invoice than the e-invoice. If you don’t act in time, you run the risk of losing touch and falling behind the competition. Early engagement with the topic of e-invoicing is therefore essential for every entrepreneur who wants to remain successful on the market in the future.